In 2010 I entered the world of Management Consulting. I loved learning how large businesses worked. Yet, I grew more and more fascinated with technology and entrepreneurship. During those days, I owned a Blackberry phone, I remember it as it was cool back then. I also remember when a good friend of mine messaged me on BB Messenger to alert me about an opportunity.

This may have been the first startup investment opportunity I had received. The startup operated across Africa, a continent close to my heart as I originate from there.

I dived right into the opportunity and invested. Six months later the startup had gone into administration. The startup suffered from working capital issues and ran out of money.

There and then, I lost any chance of a return on my investment. So what went so wrong when it all seemed so right?

Common mistakes new angel investors make

Looking back now, I made some pretty elementary mistakes.

- Investing alone.

- Investing based on FOMO (fear of missing out).

- Investing more than you can afford to lose.

These mistakes I made all those years ago are being repeated today by many angels.

Investing alone

When investing for the first time, there are so many unknown unknowns. One in five small businesses fails within their first year according to NerdWallet. I didn’t realise how risky startup investing was. If I knew this, I would have invested less or not invested at all. I invested based on my emotions and had no clear framework on how to test the opportunity. I didn't think about how to reduce my bias and get help from others.

Investing based on FOMO

I am a supporter of Manchester United and despite our poor run of form as a football team since Sir Alex Ferguson left, I still fear missing out on games in the hope that they might surprise me with a superb performance (please don’t judge me!).

Startups are exciting, you meet fascinating people solving unexpected problems. It is understandable as a newbie investor to feel in awe. Looking back, I wish I had 10-20 deals to look at before making an informed decision on which one to invest in.

Investing more than you can afford to lose

This perhaps may be the most common mistake I hear about from new angels. They invest out of excitement and learn costly lessons as a consequence. Check out this blog to learn more about investing in startups. Nowadays, I invest as little as £1,000 - £5,000 in a single startup. I often do this alongside others through Special Purpose Vehicles (SPVs). I call this small ticket investing.

Still interested in getting started?

My first angel investment in 2014 was a pivotal lesson for me. It inspired me to educate, empower and equip aspiring investors. Today I do that through my business The Angel Investing School (AIS).

Luckily, I didn’t generalise that experience and decide that “I am never investing in a startup again.” Instead, I fed my curiosity and began to question why there are so few angels and why it was such a homogenous crowd.

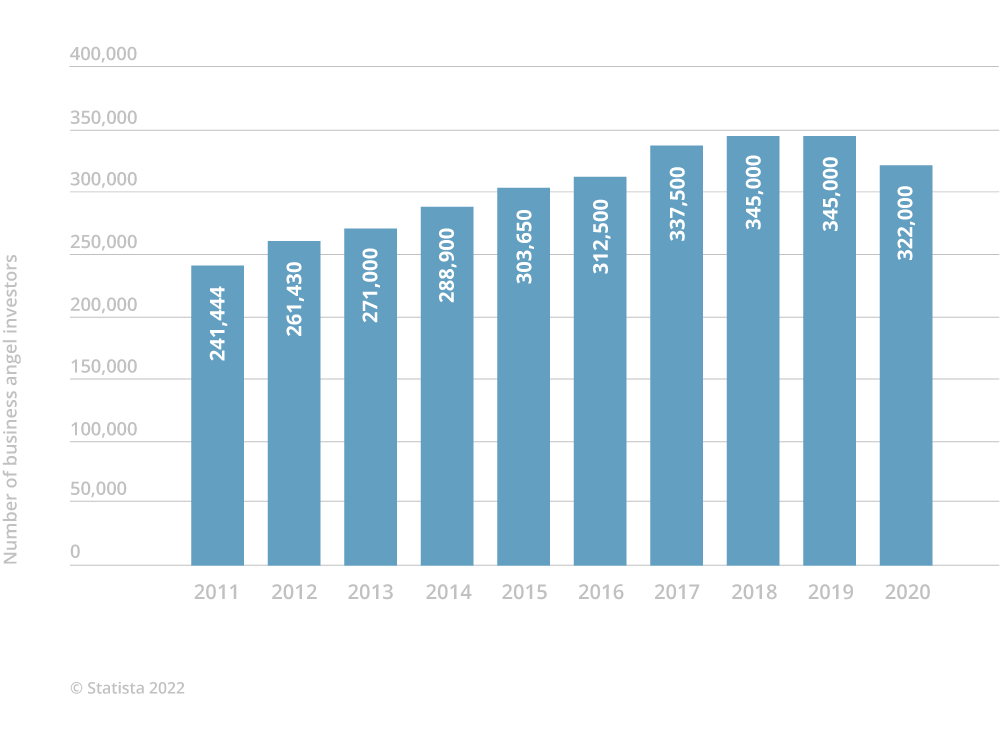

Statista states that from 2011 to 2020, Europe had approximately 322,000 angels despite a population of 740m. For comparison, there were circa 335,000 angels in the US, a population of 300m.

To make matters worse, in the UK Forbes states that around 13% of angels are women and less than 1% are Black. Whilst the UKBAA shared that 85% of UK angels are over 45 years old.

This data is the driving force behind why I am passionate about democratising access. There is a need to widen participation for diverse angel investors. Over the last 2 years, we have trained over 300 diverse angel investors. 55% were women and 75% were from different ethnicities. Professionals range from Saudi Arabia to the USA. From various backgrounds from nurses to recruiters!

The ability to invest small amounts unlocks the potential for aspiring angel investors. People who questioned whether angel investing is for them. After reading this, you too can feel empowered to get started with investing in startups. Sometimes less is more!

This article was published by Andy Ayim MBE, an angel investor and founder of The Angel Investing School.

You can learn more about Andy and the school by listening to Syndicate Room's Angel Insights podcast interview with Andy and you can sign up for the AIS membership here.

Register to learn

more about our data,

fund and venture capital