Claiming EIS tax relief is an extremely straightforward process that boils down to attaching the details of your EIS-qualifying investments to your tax return and submitting it to HMRC.

Investors claim tax relief when they complete their annual tax return, giving details of each of their EIS qualifying investments, then submitting this to HMRC.

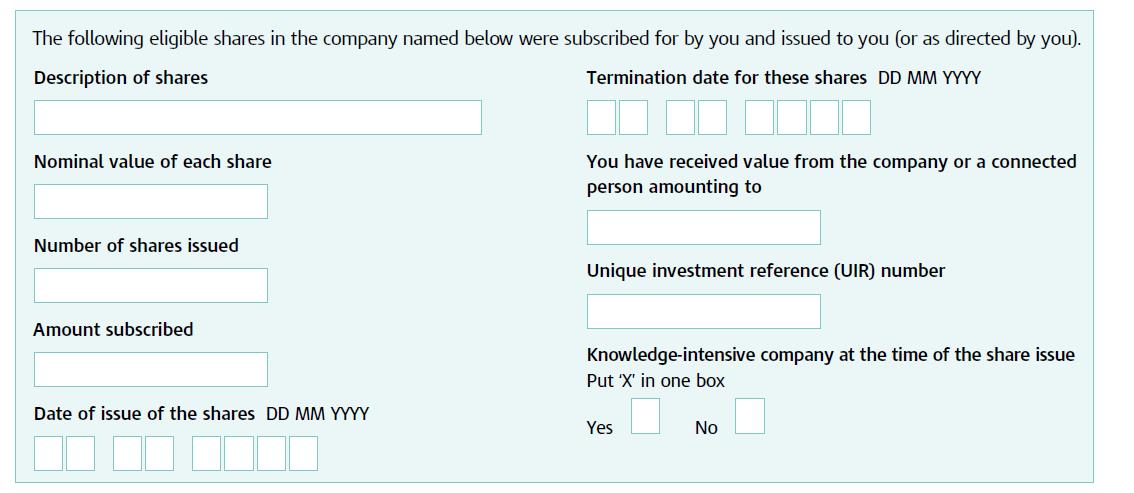

You'll need to provide HMRC with the following information:

The names of the companies in which you’ve invested.

The amounts, per company, for which you’re claiming relief.

The share issue date (often different from the date you invested).

The HMRC office authorising the issue of the EIS3 certificate and its reference (as shown on the certificate).

This information appears on the EIS3 certificates that the companies, or fund(s) on behalf of the companies, will issue to you as part of the investment process. These certificates are typically issued three to four months after the close of the companies' funding rounds. HMRC takes time to process them based on information the company supplies to them.

You cannot claim relief for an investment if you have not received an EIS3 certificate (or EIS5 if it's an 'approved' fund).

Submitting a paper return

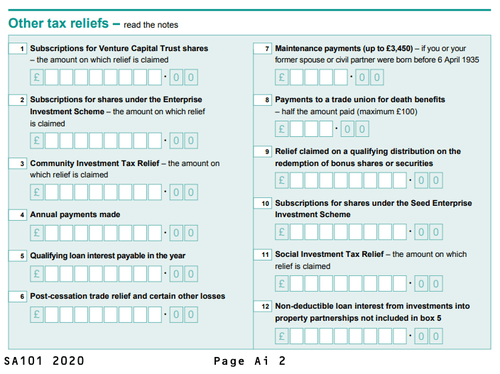

If you submit a paper tax return, use the information on your EIS3 certificate to complete the “Additional information” sheet (form SA101) and enclose it with your return.

In box two ("Subscriptions for shares under the Enterprise Investment Scheme") of the “Other tax reliefs” section, on page Ai 2, write the total amount of all your EIS subscriptions on which you wish to claim tax relief.

Submitting an online return

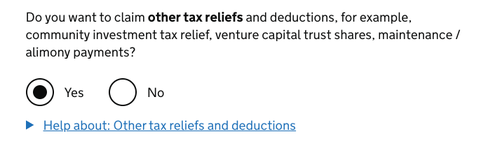

If you submit your return online, in section three of the online return – "Tailor your return" – answer "Yes" to the question on other tax reliefs.

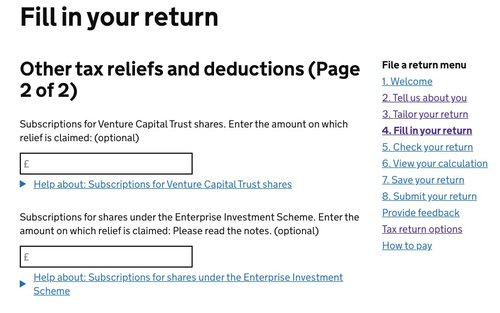

In section "Other tax relief and deductions (Page two)" of section four, "Fill in your return", type in the total amount of all your EIS subscriptions on which you wish to claim tax relief and can provide details of each of your EIS investments.

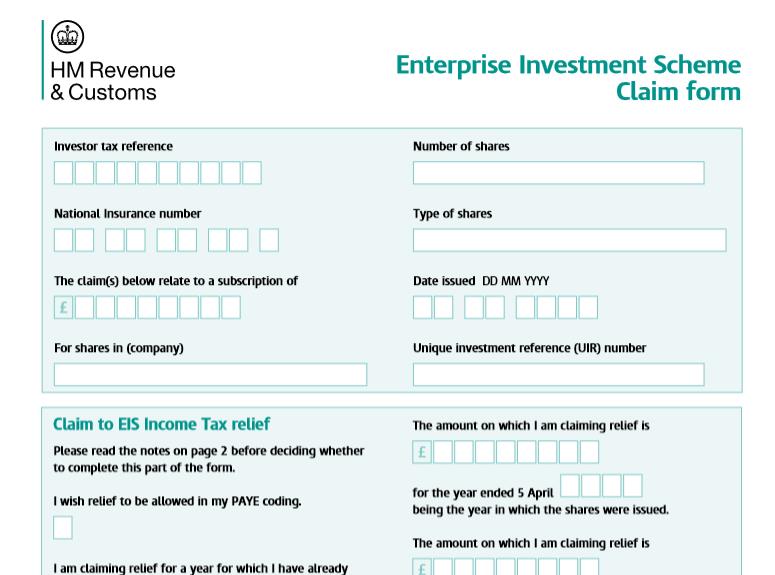

Claiming via the EIS3 claim form

The EIS3 certificate itself includes a form which should only be submitted in certain situations.

- If you wish to claim tax income tax relief, but the EIS3 arrives after you've submitted your tax return (complete the 'claim to EIS income tax relief' section).

- If you pay tax by PAYE and wish to claim tax relief for this year, or for the previous year, but do not submit a self-assessment tax return (complete the 'claim to EIS income tax relief' section).

- If you wish to make a claim for capital gains tax deferral relief (complete the 'claim to EIS deferral relief section').

For full guidance on when to use this form, please see the HMRC guidelines

For investors in the Access Fund

For Access EIS investors, all the information you need to claim tax relief, including EIS3 certificates and a spreadsheet showing the details above, can be downloaded from your Investor Dashboard, and simply attached to your completed tax return for submission to HMRC.

View our detailed, step-by-step guide to claiming tax reliefs on our website:

Busting some common EIS claim myths

You don’t have to file a separate tax return for each EIS company you’ve invested in.

You just need to list them with the relevant details and attach to your tax return.

You don’t need to include copies of EIS certificates for each company you’re invested with alongside your tax return.

You do need to have received them, and have access to them, but you don’t need to gather and submit them to HMRC unless specifically asked to do so.

I'm new to EIS – what tax reliefs does it offer?

EIS investors can claim the following tax benefits on their investments:

Up to 30% income tax relief.

The maximum investment that can be claimed on in a single year is £1m. This annual maximum rises to £2m if investments are made in Knowledge Intensive Companies (KICs).

No tax on EIS gains.

If EIS shares are sold at a profit, any gain made on that investment is tax free. Given the potential returns involved with investing in startups, this can be a significant tax break. To qualify, income tax relief on the shares that are sold must already have been claimed.

Capital gains tax deferral.

Any gain you make through selling other assets can be reinvested in EIS, and the tax on it deferred for as long as the investment is held. There is no limit on the gains that can be deferred in this way. While the rules state you cannot claim tax relief on investments into companies with which you are ‘connected’ by significant financial interest or employment, these rules do not apply where only deferral relief is claimed. More on capital gains relief.

Inheritance tax relief.

EIS shares are exempt from inheritance tax, as they qualify for Business Property Relief (BPR), but shares must have been held for two years prior to death.

Loss relief.

Investing in startups is risky, and some companies won’t make it. Loss relief allows investors to offset a loss on an EIS investment against their income tax or capital gains tax bill.

SyndicateRoom does not provide investment or tax advice. If you require either please speak to a professional advisor or accountant who may provide you with support services.

Get your copy of our whitepaper

Looking for a fund that does things differently?

Download our whitepaper here, which sets out the uniquely data-driven, co-investment model of our fund, Access EIS.

Register to learn

more about our data,

fund and venture capital