What is business relief?

Business relief (BR) is an inheritance tax (IHT) relief that reduces tax paid on certain business assets and investments. Assets covered by BR fall into two categories with one reducing IHT by 50% and the other reducing it by 100%. Introduced by the 1976 Finance Act as Business Property Relief (BPR) it is now a key component of inheritance tax planning.

You do not need an adviser to invest in BR-qualifying funds. However, we recommend speaking to your financial adviser before making any investment decisions.

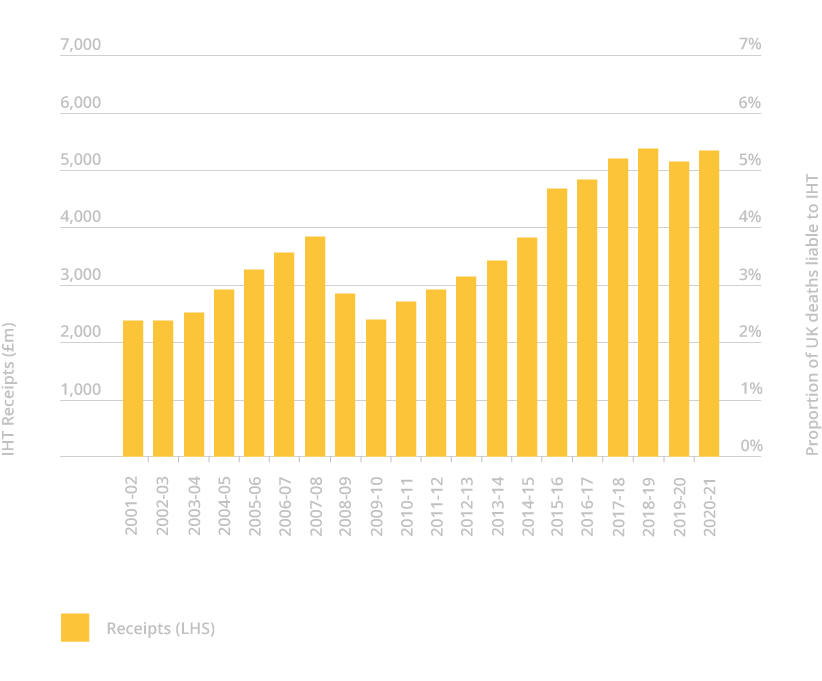

The graph below depicts how inheritance tax has increased over time:

Graph showing IHT receipts from tax year 2001 to 2002 to tax year 2020 to 2021

Which assets qualify for business property relief?

For any asset to qualify for BR it must be owned for at least two years before death.

The business owned or invested in must qualify for BR by passing HMRC’s 50% trading test. This test checks that over 50% of a business' activity is in “trading” and less than 50% of its activity is in “investments”. Investment activities include:

- Purchasing stocks and shares

- Buying land and/or buildings

- Holding investments

If the business passes the 50% trading test it will qualify for one of two levels of business relief.

The higher level of assets qualify for 100% BR and include:

- Holding an interest in a business that is an unlisted public limited company (PLC)

- Shares in a private limited company (Ltd)

- Shares listed on the Alternative Investment Market (AIM)

- Ownership of a sole trader business

- Part-ownership of an unincorporated business (partnership)

The lower level of assets qualify for 50% BR and include:

- Quoted shares that grant control over a company

- Land, buildings or machinery used primarily or exclusively for the purposes of the business

- Land, buildings or machinery used in a business carried on by a beneficiary

Get your free guide to EIS and inheritance tax

Why EIS may be a good option for your portfolio

Do you know the value of your estate? The number of UK households likely to face an inheritance tax bill is increasing every year. Find out more about reducing your inheritance tax bill with business relief and EIS, along with the tax reliefs and potential for returns available to EIS investors in our latest publication.

What types of fund or services offer business relief?

Inheritance tax services.

Sometimes called an “estate planning service”, providers invest client money into a small number of BR qualifying businesses, occasionally just one.

The approach is designed to protect investors' assets from inheritance while targeting a modest level of return over the investment period.

AIM IHT portfolios.

These typically come in two varieties with the first available inside an ISA and the second without it. Those that come in the ISA are referred to has AIM IHT ISA portfolios.

In both cases, investments made into BR-qualifying AIM-listed shares should enjoy IHT.

The added benefit of the ISA option is that portfolio growth and income are both tax free.

With either option the shares should become IHT free after a two year holding period, provided you still hold them on death and they remain qualifying.

EIS funds.

EIS funds are both the least liquid and most growth-oriented of the options. EIS funds invest in a portfolio of early-stage high-growth and high-risk companies that offer investors more than inheritance tax relief.

Why EIS may be a good option for your portfolio

In addition to the inheritance tax relief, the Enterprise Investment Scheme (EIS) offers a number of other reliefs. These reliefs include:

30% income tax relief.

Investors can claim 30% of their EIS investment as income tax relief on their tax bill. This can be used in the year of investment or carried back one tax year.

Deferral of capital gains.

Gains made on the sale of another asset can be deferred by investing them into EIS. The initial capital gains tax becomes due when the EIS investment crystallises - rolling it into a new EIS investment defers it again.

No tax on EIS gains.

There is no capital gains tax paid on the profit from EIS investments held for a minimum of three years. Investors must claim the initial EIS income tax relief for this to qualify.

Loss relief.

Investing in startups is risky, and some companies won’t make it. Losses on an EIS investment are special in that they may offset income tax or capital gains.

Why the Access EIS fund may be the right EIS fund for you.

Access is a venture capital fund that offers investors EIS tax relief while building a portfolio of highly selective startups.

Further, research by Hardman & Co found that including an optimal proportion of venture capital can have a positive impact on portfolio returns while maintaining, or reducing, the overall portfolio risk.

As Access EIS invests in EIS qualifying companies eligible investors may benefit from Inheritance Tax relief as well as all of the other tax reliefs that the Enterprise Investment Scheme affords.

Frequently asked business relief questions.

How do I claim business relief?

BR can be claimed on a lifetime gift or on death. To claim BR on a lifetime gift, the gift must be made more than seven years before the transferor's death. To claim BR on death, the business asset must be owned by the transferor at the time of their death and must have been used in a qualifying business for at least two years before their death.

Can I claim business relief on a business that is no longer trading?

Yes, you can claim BR on a business that is no longer trading, provided that the business was used in a qualifying business at the time of the transferor's death.

Can I claim business relief on a business owned by a trust?

Yes, you can claim BR on a business owned by a trust, provided that the trust meets the relevant criteria.

What happens if I sell a business asset that qualifies for Business Relief?

If you sell a business asset that qualifies for BR, you will lose the ability to claim BR on that asset. However, you may be able to claim BR on other business assets that you own.

What are the risks of BR qualifying investments?

Companies that qualify for BR – both those listed on the AIM, and unquoted – are often as an earlier stage of their development. As such there is an increased risk of them decreasing in value.

Tax rules can and do change. There are no guarantees that the tax benefits enjoyed today will remain in the future.

A further consideration is liquidity. Shares on AIM or in unquoted companies are harder to dispose of than main market-listed shares.

What are the common assets excluded from BR?

- Buy-to-let properties.

- Any assets or even the business as a whole for not-for-profit organisations.

- Loans made to companies or partnerships.

- Property owned by shareholders and used by a company (as opposed to property owned by the business itself).

- Assets that qualify for Agricultural Property Relief.

Disclaimer.

The information on this page does not constitute financial advice and is provided on an information basis only, based on research using the following sources: