ISAs are certainly the more familiar option, but are they the best option?

ISAs are a reliable feature in the investing landscape: easy to understand, relatively low risk (although this can vary with the specific type of ISA), and open to everyone.

By contrast, EIS, despite being long-established, is often considered a more fringe investment. Sure, the tax incentives are tantalising, but what about risk? And how do you claim the tax reliefs anyway?

It might be time to re-appraise: EIS is today considered a much more mainstream investment than it once was, and while it is riskier than ISAs, it has a number of benefits that might be appealing to certain investors. Let’s look at why EIS might be a better option for your next investment.

Tax reliefs

Many people turn to ISAs to take advantage of the tax-free interest, and in the case of stocks and shares ISAs, tax-free dividends and capital gains tax exemption. However, the raft of tax reliefs, deferral options and loss relief available to EIS investors outstrips the benefits of ISAs by a significant margin.

EIS offers:

- 30% income tax relief on up to £1m each year.

- Capital gains tax exemption after 3 years.

- Option to defer capital gains tax.

- Inheritance tax exemption after 3 years.

- Loss relief on eligible companies.

On top of this, the income tax relief can be carried back and applied to an earlier tax year.

All together, these make for some significant savings. The amount saved in tax relief alone through EIS makes the potential gain of ISAs less significant by comparison.

Get your free guide to EIS

Want more information on EIS tax reliefs?

Download your copy of our free guide. Featuring an analysis of UK investor trends, investment case studies and an EIS cheat sheet.

Returns

The annual return on a cash ISA is negligible, between 0.5 and 2%. It’s better for a stocks and shares ISA, as you’d expect, but still, the yearly average return is 5.14% (that’s the average return for April 1999 to April 2020).

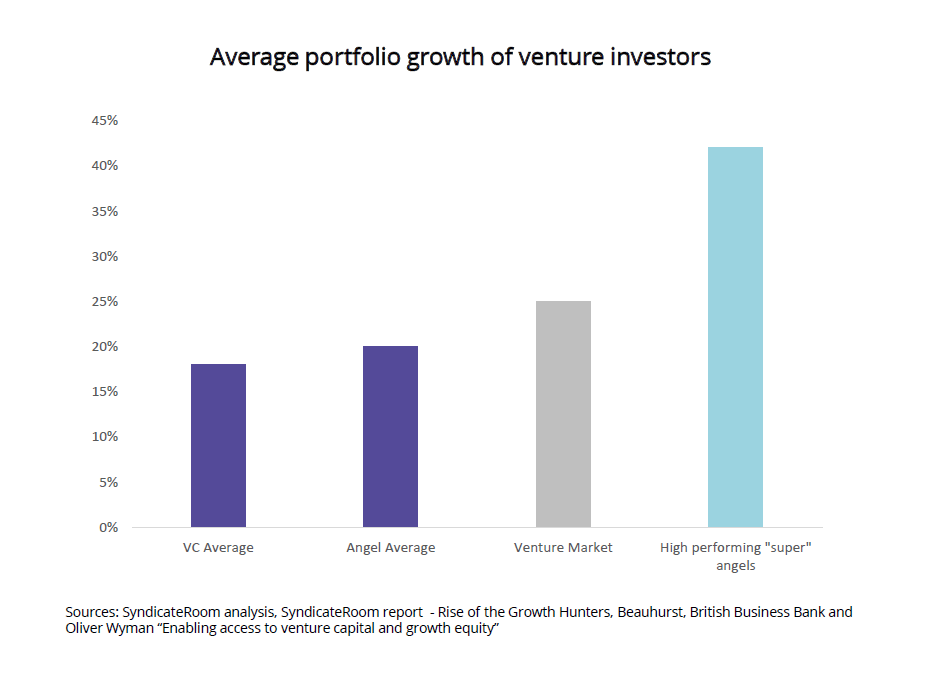

Compare this to the annual growth rate of the UK startup market, which is approximately 28%. Then compare that to the average IRR of the best angel investors’ portfolios, which is around 42%. You can quickly see that, while EIS is of course a high risk investment, it has the chance for extremely significant returns.

If you’re not an experienced angel investor, you can still gain access to this kind of IRR. How? There are EIS funds that handpick and co-invest with the best investors in the UK in order to access the best deals, and potentially hit those high rates of return.

Risk?

ISAs, and cash ISAs in particular, compensate for their low rate of return by posing little risk. Stocks and shares ISAs of course, can be significantly more risky. The average stocks and shares ISA fund in the UK fell by 13% in the 2019/20 tax year, largely due to the pandemic, but this has increased by 15.57% in the new tax year, as markets anticipate a return to business as usual.

Mitigating risk with a stocks and shares ISA is done through diversification of your investment, so that if events affect one industry negatively, you still hold other, unaffected stocks and shares to balance things out.

The same approach can also be taken with EIS, particularly if you invest in an EIS fund that emphasises diversification, rather than hand-picking your favourite biotech companies, for example, or trying to pick a small number of ‘winners’. One fund in particular, Access EIS, has built its funding model around the optimum portfolio size to capture annual UK startup market growth – 50+ companies – while reducing risk as much as possible.

The bigger picture

It’s not important to everyone, but to some, it’s crucial. Investing in EIS promotes the growth of new businesses, supports the UK economy, and fosters innovation - often in industries and technologies that stand to make a significant positive impact on the world, whether it’s clean energy, battery power, drug discovery, diversity… the list goes on.

While an ISA may present a less risky investment opportunity, you are still losing a chunk of your income to tax that you could save by investing in EIS, and know that you were putting your investment towards something that you were personally keen to support, if not passionate about.

Data-driven venture capital: the Access EIS fund.

If you’re looking for a fund with a relatively low minimum investment (£5,000), a large portfolio of 50+ companies for each individual investor, all the tax relief options that come with EIS and an innovative investment model – it co-invests with expert angel investors with an average IRR nearly double that of the market – one option worth looking at is the Access EIS fund, operated by SyndicateRoom. It was recently ranked among the most active venture capital funds in London (Beauhurst, 2021), and is definitely worth a look if you’re exploring options for retirement planning and want to start with a modest outlay. They’re a very approachable team, who are happy to answer any queries you may have over the phone.

Register to learn

more about our data,

fund and venture capital