In June, we added three new startups to the Access portfolio, co-investing alongside angel investors in each case (for more on our super angels and our co-investment model, see our dedicated page).

Read on for more about our latest investments. If you would like to receive this update each month, sign up for our newsletter here.

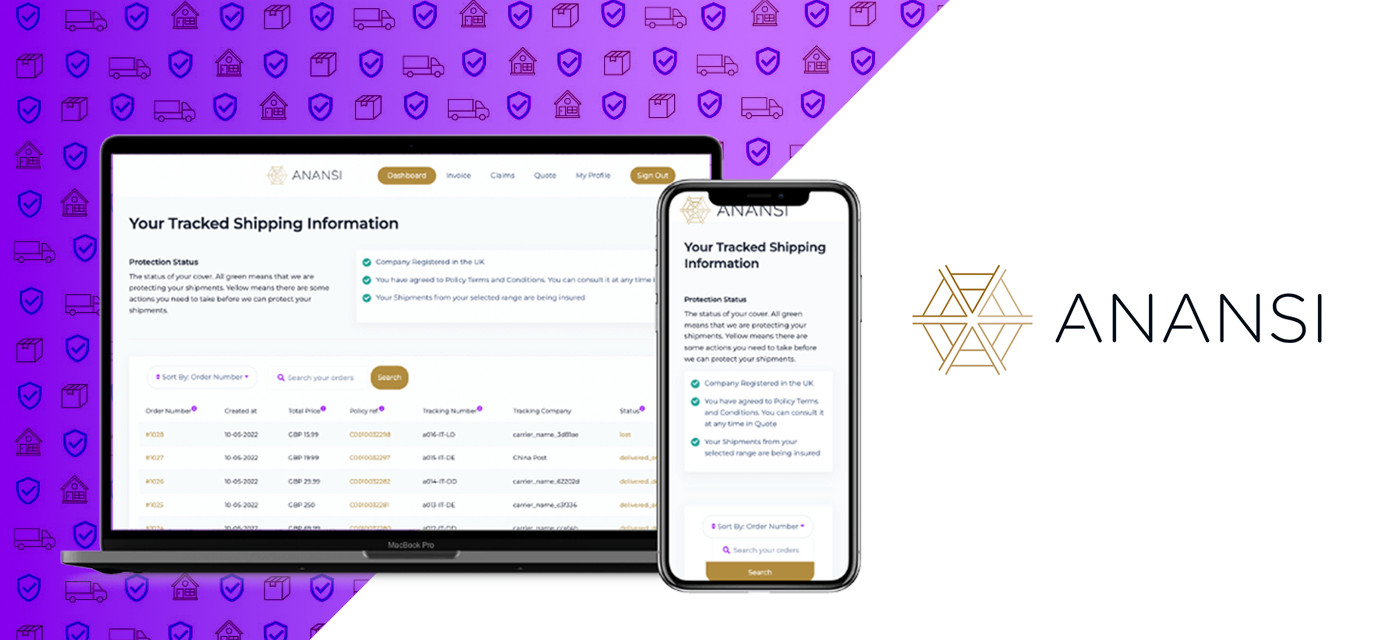

Anansi

Anansi has developed a better way for merchants to insure goods in transit that brings a frequently frustrating system up to 21st century standards, with digitised processes and automated, hassle-free claims forming the basis for a range of insurance products.

Pre/post revenue: Post-revenue.

Angel: Our angel partner in the round has a weighted IRR of 67% and has invested in Marshmallow, Railsr and Atom, amongst others.

Total Round: approx. £1,000,000

Thymia

Thymia's ethical A.I. models analyse voice, movement and behaviour to provide clinical grade insights into mental health and wellbeing. At the pre-clinical level it works with providers of mental wellbeing to measure indicators of burnout and other pre-clinical indicators of mental health. At the clinical level it is developing a tool to support clinicians in triaging, diagnosing and more effectively treating mental illness.

Pre/post revenue: Pre-revenue.

Angel: Our angel partner in the round has a weighted IRR of 45%. This angel has also invested in Form3, Baked In & M:QUBE.

Total Round: approx. £2,500,000.

Appfactor

AppFactor is designed to eliminate the time, risk and cost constraints of manually modernising business applications, delivering a scalable, repeatable factory model purpose-built for cloud native modernisation. It allows users to accelerate the journey to cloud-native architecture and modernised DevOps.

Pre/post revenue: Pre-revenue.

Angel: Our angel partner in the round has a compound average growth rate of 47%. This angel has also invested in Tessian, Koru Kids & Papier.

Total Round: approx. £750,000.

If you’re interested in the Access EIS Fund and would like to find out the benefits of investing, you can call us on 01223 478 558 and we'll be happy to answer any questions you might have.

Or, if you're ready to make an investment, click the button below:

What is Access EIS?

Read our fund brochure for everything you need to know about the Access EIS Fund, from the specifics of our innovative co-investment model to our fees, and how to invest.

Register to learn

more about our data,

fund and venture capital