Where do most investors start?

A major advantage of investing – in addition to the potential for returns – can often be gaining access to the tax reliefs available through specific types of investment.

While tax efficient options are of course available even for savers through ISAs and pensions, many people begin looking for additional methods of optimising their tax efficiency once they’ve used their ISA and pension allowances.

Tax efficient investment schemes like EIS, SEIS and VCT, each of which offers its own set of tax benefits, give investors the opportunity to increase the amount of invested capital that’s eligible for tax savings, while putting their money to work in the UK’s flourishing startup ecosystem.

Why do investors turn to venture capital for tax efficiencies?

For many investors, this opportunity to be tax-optimal while supporting businesses, technologies, and sectors about which they are particularly passionate, in many cases lending the benefit of their insights or expertise to the next generation of businesses, and helping to foster new innovation while supporting the British economy, is particularly appealing.

In 2024, following several challenging years for startups that have nonetheless borne witness to the rise and maturation of game-changing technologies like generative AI, a range of advances in green and climate tech, and significant developments in health and wellness tech, tax-efficient investing is able to deliver a great deal to investors beyond access to tax benefits. Many investors find the tax-benefits an added bonus to making investments.

Venture capital schemes

Tax efficient investments using venture capital schemes can offer investors a great deal of flexibility around specific types of tax. They can be used like a tax-efficient toolkit to ensure that whether you’re selling a second home, planning your retirement, or managing a large tax bill within a specific tax year, you have options at your disposal.

Below we’ll look at some types of tax relief available and strategies for their application.

Tax efficient investments and their tax advantages

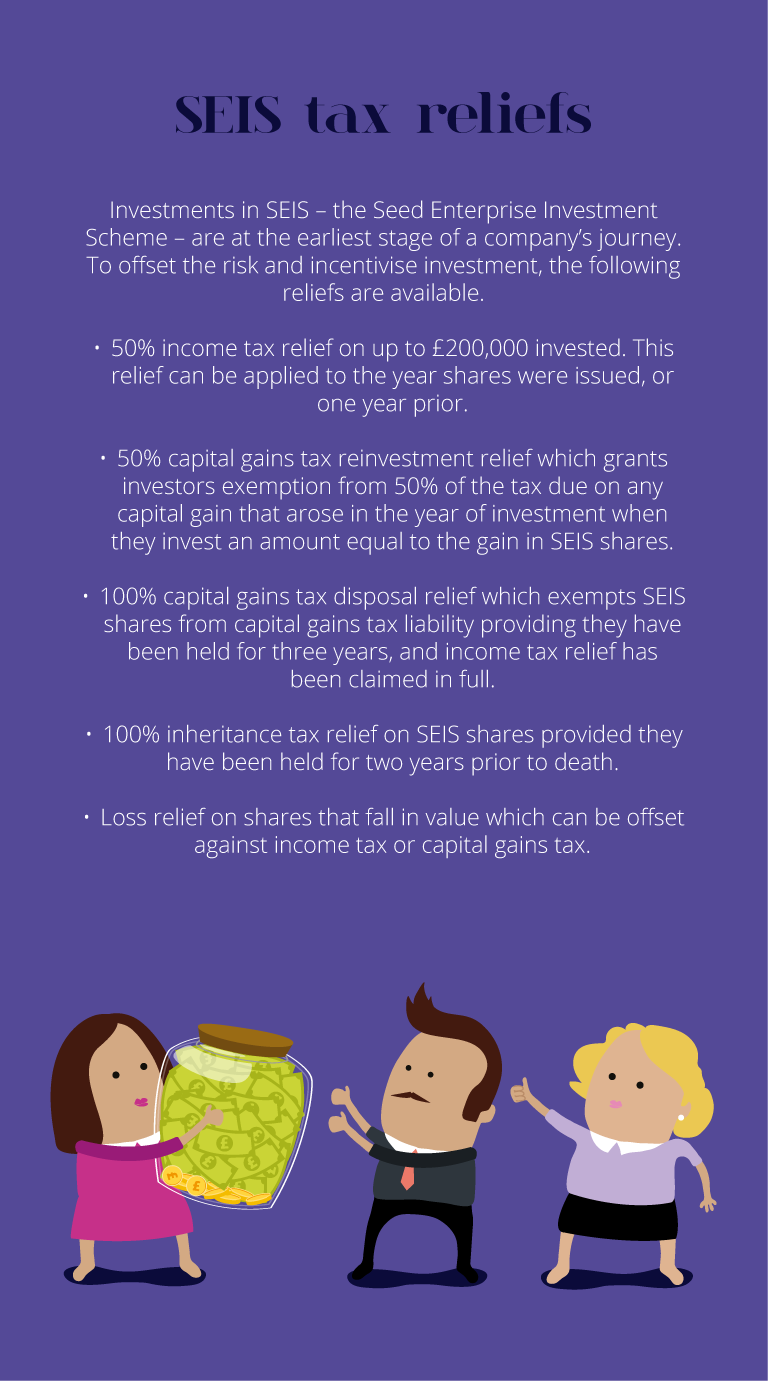

SEIS

SEIS strategies

Timing SEIS investment to make use of 50% capital gains tax relief around asset sales

One of the standout tax reliefs available through SEIS is the ability it offers investors to effectively cut a capital gains tax bill in half. For SEIS, this requires the gain to have arisen in the same year you invest in SEIS shares, and for the amount you invest to be equal to that of the gain.

But it means that investors can plan to sell second properties or assets that will cause a gain to arise and invest in SEIS at the same time and see a significant reduction to their CGT bill, and include SEIS investing as a tax efficient strategy when they plan to dispose of assets.

50% income tax relief across two years worth of bills using carryback

The ability to apply 50% income tax relief to prior and current tax years gives investors significant control over tax reduction. For SEIS, the amount on which tax relief can be claimed is £200,000, for a maximum claim of £100,000 in income tax relief. But because of carryback, investors can technically invest £400,000, then treat £200,000 worth of shares as having arisen in the prior tax year, and so apply tax relief of £100,000 to the prior tax year, and £100,000 to the current tax year.

Of course, not everyone will have an income tax bill large enough in each tax year for this to be useful. But whatever the amount that you choose to invest, you are able to split the application of tax relief across two years. This can make it a useful strategy if you’re expecting a large tax bill, and want to make an investment that will be applicable to it, and not just to future tax bills. Do bear in mind that you will need to invest in SEIS shares at the correct time, so that your investment has deployed, and you have received your SEIS share certificates, before you can claim income tax relief on those shares.

Quick scenario

In January 2025, John files his tax return to pay £100k in income tax for the 23/24 tax year, which he pays in full before the deadline.

He wants to reduce this amount however, so he invests £400,000 in SEIS that same month, and receives the SEIS share certificates for his investments in October 2025. He then makes a claim – using the claim form on the SEIS certificates – for 50% of £200,000 worth of shares he was issued in the 25/26 tax year, and carries this back to the 23/24 tax year, applying £100,000 income tax relief to his tax bill, receiving a rebate from HMRC.

In January 2026, he finds out that he has another income tax bill of £100k. Because he holds a further £200,000 of SEIS shares issued in that tax year upon which he has not yet claimed relief, he can make a claim on these shares for the current tax year, and apply £100,000 tax relief to his income tax bill.

NOTE: We’ve used the maximum amount that relief can be claimed upon in this example. But in most cases, investors will tailor the amount they invest to their expected income tax liability in each year.

Exempting assets from inheritance tax quickly

SEIS and EIS shares are exempt from inheritance tax under business relief rules, providing they have been held for two years.

Generally, assets only cease to be liable for inheritance tax when they are gifted more than seven years prior to death. By making an investment in SEIS or EIS, investors are able to acquire assets that are IHT exempt much more quickly, which can make them a useful strategy for retirement planning.

You can read more about EIS and inheritance tax in our dedicated guide

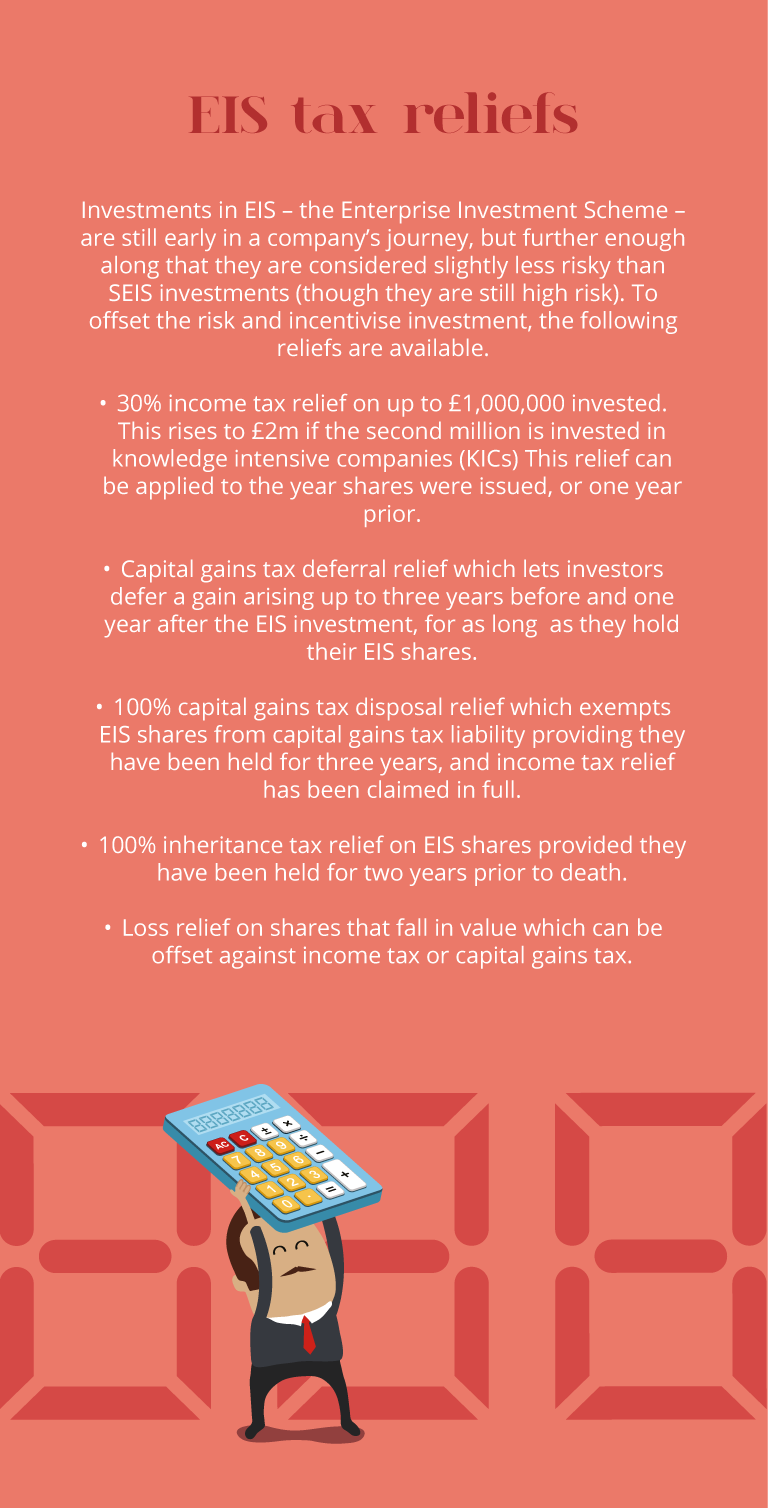

EIS

EIS strategies

Making use of 100% capital gains deferral relief around asset sales, with a four year window.

With EIS investing, the relief around capital gains tax comes in the form of deferral. By investing an amount in EIS shares that’s equal to a taxable gain that’s arisen up to one year prior, or three years after your investment, you can treat that gain as if it hasn’t arisen for as long as you hold your EIS shares. If you sell your shares, you can defer the gain again by investing the same amount in further EIS shares. You can choose to defer as much or as little of any gain as you like - the amount invested in EIS is the amount you can defer.

In practice, this means that if you continue to invest in EIS on an ongoing basis, you can defer that gain indefinitely. You can also make further investments in EIS to defer other gains that might arise.

This makes investing in EIS a useful strategy for investors looking for a little more control over capital gains tax management, or for those who have sold an asset, paid capital gains tax, but which to reclaim it and defer that gain. Unlike SEIS, there is a four-year window for capital gains with EIS, so EIS investors have a great deal of flexibility around when they choose to invest in relation to when their gain arises, which makes it ideal for property sales that may take longer than expected.

You can read more about EIS and capital gains tax in our dedicated guide

30% income tax relief across two years worth of bills using carryback

The ability to apply 30% income tax relief to prior and current tax years gives investors significant control over tax reduction. For EIS, the amount on which tax relief can be claimed is much higher than SEIS: £1,000,000 for regular EIS shares, rising to £2,000,000 if the second million is invested in Knowledge Intensive Companies (KICs).

Following the same method as discussed above under SEIS – this means that with a large enough investment (of £4m, £2m of this in Knowledge Intensive Companies), investors could potentially use carryback to claim a total of £1.2m in income tax relief, applying £600k to the prior year, and the remaining £600k to the current year.

In practice, the number of investors choosing to invest this amount of money in EIS will be very small, but it gives you the idea. By investing in EIS, you gain a significant degree of control over your income tax bills in prior and current years – the amount you choose to invest is really down to the expected size of your bill and personal circumstances.

Whatever the amount that you choose to invest, you are able to split the application of tax relief across two years. This can make it a useful strategy if you’re expecting a large tax bill, and want to make an investment that will be applicable to it, and not just to future tax bills. Do bear in mind that you will need to invest in SEIS shares at the correct time, so that your investment has deployed, and you have received your SEIS share certificates, before you can claim income tax relief on those shares.

Claiming tax relief

Claiming EIS and SEIS tax relief and deciding which years to apply the relief to is a straightforward process that can be done either on a Self-Assessment tax return (paper or online), or using the forms on the back of your EIS and SEIS share certificates. You’ll find more information about how to claim in our article here.

One common misconception around claiming tax relief is that investors need to file a separate return for each company in which they hold shares. This is not the case. You simply list all the shares you hold in EIS or SEIS qualifying companies in the relevant places in a single tax return, or on your share certificate.

SyndicateRoom offers the following SEIS and EIS products to investors

Founders Factory B2B SaaS Investment Programme SEIS FUND 1

This fund, powered by Founders Factory, presents an opportunity to invest in a portfolio of eight promising new pre-seed companies in the B2B SaaS sector. Founders Factory will support these companies with a programme designed to help them kickstart their growth at the earliest possible stage, as well as ready them for introduction to its contacts at top technology companies, VCs and corporates. Minimum investment: £10,000.

Find out more about the Founders Factory B2B SaaS Fund.

The Access EIS Fund

We spent three years analysing the UK startup market and found that in its entirety, it grows by around 25% year on year.

We set about devising a method to capture this market growth for our investors by building them the most diverse portfolio currently available on the market. Minimum investment: £5,000.

Register to learn

more about our data,

fund and venture capital