Venture capital funds are having their moment in the UK as a record amount of capital was invested in the first quarter of 2021, hitting £5.1 billion, up 21% on the previous quarter. Institutional investors in particular are flooding into VC with the hopes of achieving outsized returns and even retail investors are getting in on the action with new funds on the market lowering the barrier to entry to a £5,000 investment.

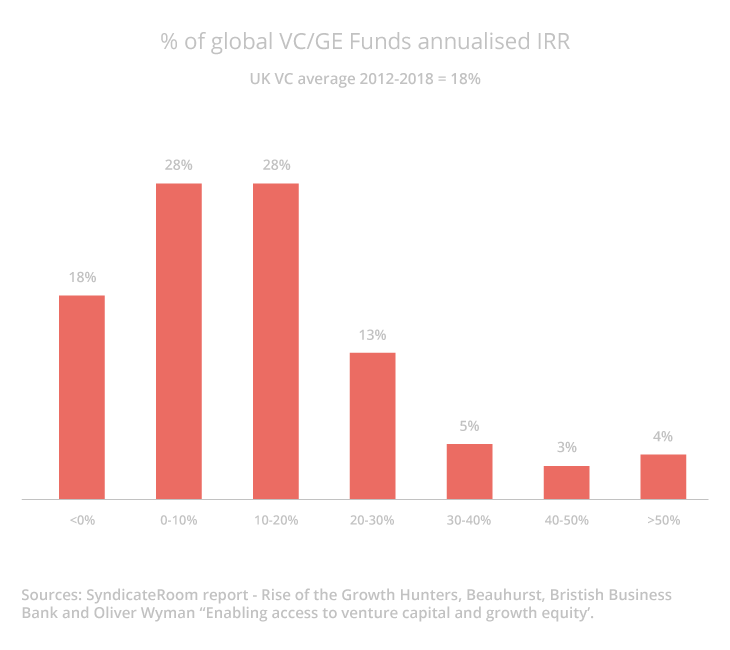

However, data from the British Venture Capital Association (BVCA) shows that while the average annual growth of global VC/GE funds stands at a healthy 18%, nearly 75% of VC funds do not hit this growth, 46% achieve 10% annualised growth or less and nearly 20% return less than was invested. With so much inherent risk one wonders if it’s worth the investment. Below we explore the wider VC market looking at why the returns in VC are so variable and how new models take advantage of diversification to reduce the risk while tapping into the upside.

Failure is inevitable

Nobel Prize winner Harry Markowitz had it right when he said 'diversification is the only free lunch in finance' and this applies even more to venture capital funds than it does to those that are publicly traded. The problem with most traditional VC funds is that their level of risk is a compound of the riskiness of each underlying investment (the startup they have invested in) and the lack of diversification within the portfolio which often contains ten or fewer investments.

Startups are notoriously risky investments. Data from Fundsquire shows that 20% of UK businesses fail in their first year and around 60% go bust within their first three years. Given the size of the startup pool from which to select investments, thousands of companies raise capital each year, but uncovering one that is going to provide exceptional returns is bound to be difficult.

So why then do most VCs restrict portfolio size to somewhere between five and fifteen investments? Based on the above, they are getting it wrong and are not sufficiently diversified to take advantage of the market. So what portfolio size would be needed to do just that?

Optimising for portfolio size

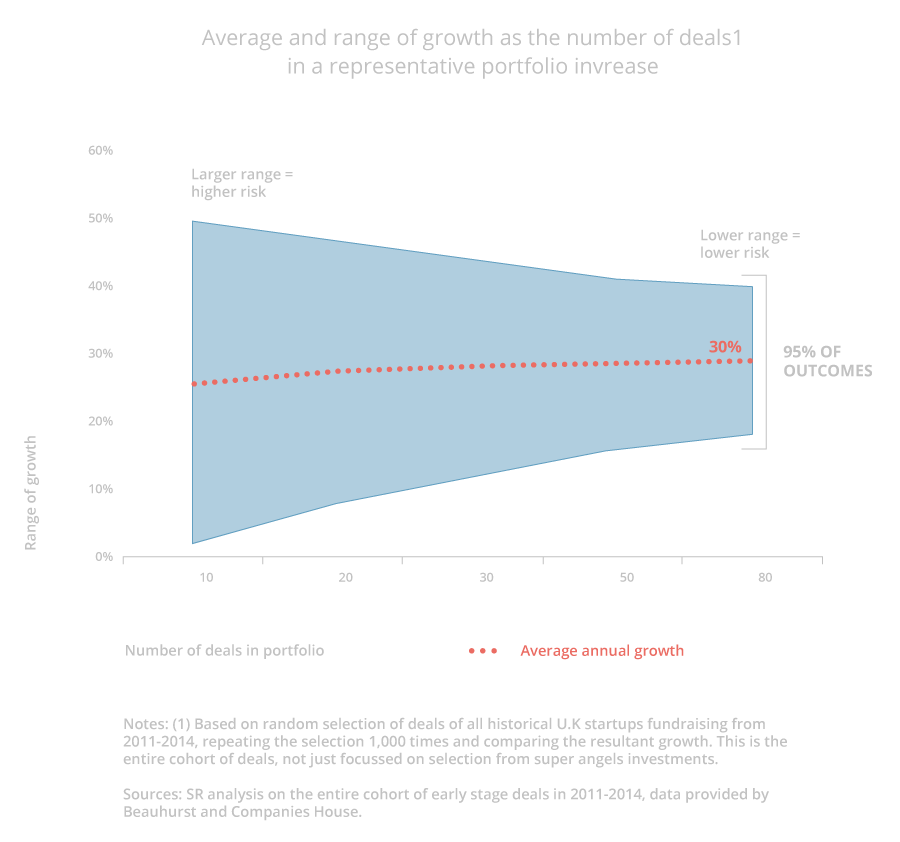

Research conducted on the entire UK startup market shows clearly that portfolios start to converge on the market level of return at around 50 investments in a portfolio. The convergence continues, but at a reduced pace as the portfolio size exceeds this figure.

However, the above is reliant on having access to the entire market i.e. a knowledge of all fund raises and an ability to invest in all of them, should that be desired. Unfortunately this is not the case as keeping track of so many companies and getting access to their rounds is just not feasible, but there is a way to stack the odds in favour of beating the average market returns.

Tipping the scales

One of the key findings of the research was that there existed a group of angel investors (individuals who invest their personal capital into early stage companies in return for equity) who consistently outperformed the market.

While it may be down to their connectedness (as denoted by the green dots in the network map below), experience, skill and probably a bit of luck as well, these individuals have repeatedly backed companies that have gone on to grow substantially.

In fact, the annualised average Internal Rate of Return (IRR) for this group of angel investors exceeded 44% over the last ten years.

Access to the groups that these individuals belong to is often restricted but, for those of us willing to take on the risk, there is a way to get access to similar returns.

SyndicateRoom has struck up relationships with 50 of the strongest performing super angels and for a relatively low minimum investment (£5,000) offers retail and professional investors an opportunity to gain access to their portfolios.

The Access EIS fund co-invests with these angels and builds investors a large portfolio of 50+ companies, and the benefit of the tax reliefs that come with EIS investments.

Register to learn

more about our data,

fund and venture capital