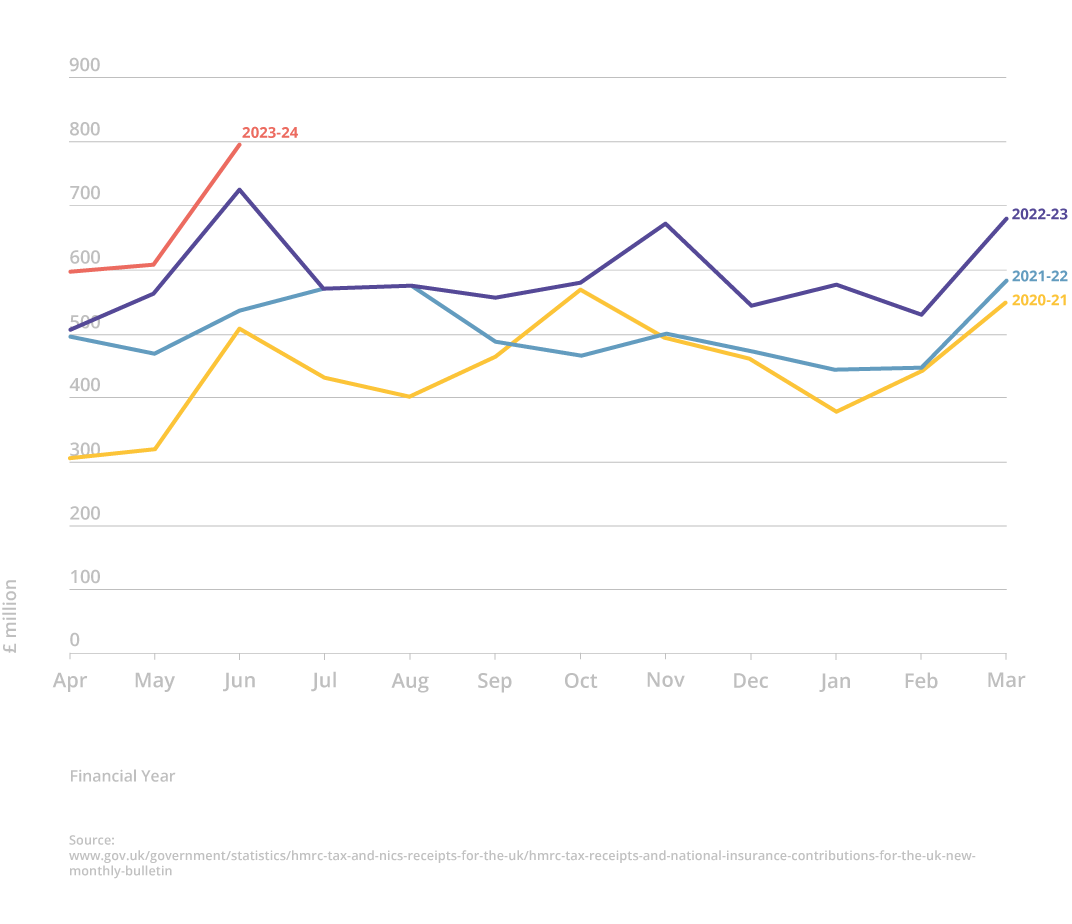

Figures from HMRC published in April show that receipts from Inheritance Tax (IHT) have increased by £1bn over the past twelve months with speculation that inflated house values play a key role in this upswing.

For those unaware, inheritance tax is effectively an estate tax charged by HMRC when someone passes away. It is pretty steep: 40% on the amount of an individual’s estate exceeding £325,000 (though this increases by a further £175,000 when the primary residence is handed down, or sold, and it goes to the children or grandchildren).

Once considered a ‘death tax’ that only affected the wealthy, the number of individuals paying IHT has increased and is projected to increase further over the next five years. This in turn has led to an increase in the demand for inheritance tax relief, and led an increasing number of people to seek out financial advisers to help them with inheritance tax planning.

For similar reasons, the number of people seeking out investment products and opportunities that offer inheritance tax relief – such as the Enterprise Investment Scheme (EIS) and the earlier stage Seed Enterprise Investment Scheme (SEIS) have also been on the rise, indeed, these schemes saw an increase in investment of 39% from 2020 to 2021, compared to the previous period (source)

Monthly inheritance tax receipts

Investments that offer inheritance tax relief

Inheritance tax relief comes in many forms. One common method to reduce the overall rate of tax on your estate is to give a portion of it to charity. The rate of tax falls from 40% to 36% if at least 10% of your estate is donated in this way.

Another method is to make investments that offer IHT exemption. SEIS and EIS investments fall into this category, as shares purchased within these schemes – which are shares in unlisted companies – qualify for Business Property Relief (BPR).

Through Business Property Relief, if you own business assets or shares in unlisted companies for a minimum of two years, your estate may be entitled to relief from inheritance tax. The type of business you own, or investment made, will dictate if it qualifies for BPR at 100%, 50%, or if it does not qualify.

To qualify for 100% inheritance tax relief you must own:

A qualifying trading business or an interest in one. Shares in an unlisted qualifying company, including a minority holding. Shares in a qualifying company listed on the Alternative Investment Market (AIM) of the London Stock Exchange.

To qualify for 50% inheritance tax relief you must own:

Shares controlling more than 50% of the voting rights in a listed company. Land, buildings, or machinery owned by the deceased and used in a business they were a partner in or controlled. Land, buildings, or machinery used in the business and held in a trust that it has the right to benefit from.

Are EIS investments IHT free?

The Enterprise Investment Scheme offers investors a wide number of tax reliefs including inheritance tax relief on shares held for a minimum of two years. The EIS shares are passed on to the beneficiaries with no IHT charged and no EIS clawed back should the death occur after two years but before three years. Additionally, if a capital gain was initially deferred into EIS, the capital gain does not come back into play upon death so the beneficiaries will not have to pay CGT that might have been owed by the deceased.

It is important to note that while no IHT is paid, the beneficiaries will no longer be protected by the capital gains tax exemption offered by EIS, even if the shares were held for more than three years.

All EIS shares will be valued at the point that they are transferred to the beneficiaries. Should the shares later be sold at a value higher than that at the point of transfer, they will be subject to capital gains tax on the increased value.

Inheritance tax planning

A special note about using EIS for inheritance tax planning. While there is an upper limit on how much an investor can invest through EIS per year and claim income tax relief on, there is no upper limit on how much they can invest through EIS and receive inheritance tax relief on.

For income tax relief, an investor can receive 30% relief on investments of up to £1m into EIS qualifying companies, £2m if the companies are knowledge intensive. For inheritance tax purposes, they can invest as much as they’d like, as there is no upper limit to the amount that is exempt from IHT.

EIS beyond the inheritance tax relief

While we have seen that EIS can be useful for inheritance tax purposes, do not forget that there are many other tax reliefs on offer.

Up to 30% income tax relief

Invest £5,000 and with EIS you’ll be able to claim up to £1,500 in income tax relief

No capital gains tax on EIS gains

There is no capital gains tax paid on the profit of an EIS investment so long as the shares are held for a minimum of 3 years.

Loss relief

Should an EIS investment go south an investor can claim loss relief on it and use it to either reduce their income tax bill or offset capital gains elsewhere.

Capital gains deferral

Investors who opt to invest the capital gain from the sale of another asset into EIS can hold off on paying the capital gains tax on it until a gain is realised on the sale of the EIS shares.

You can read more about the Enterprise Investment Scheme here.

- SyndicateRoom does not provide investment or tax advice. If you require either please speak to a professional advisor or accountant who may provide you with support services.

The Access EIS Fund

Our fund co-invests with proven angel investors to build large portfolios of hand-picked companies for our investors. It’s a high risk investment, and we can’t guarantee that every startup will be a unicorn, but we’re confident that our approach is the smartest on the market. Even better, we can show you the data to prove it.

If you’re interested and would like to find out the benefits of investing as early in the tax year as possible, you can call us on 01223 478 558 and we'll be happy to answer any questions you might have.

Or, if you're ready to get started, click the button below:

What is Access EIS?

Read our fund brochure for everything you need to know about the Access EIS Fund, from the specifics of our innovative co-investment model to our fees, and how to invest.

Register to learn

more about our data,

fund and venture capital