What is capital gains tax?

Capital gains tax (CGT) is the tax payable whenever the sale of an asset generates a profit. That profit is known as a capital gain, and arises from the sale of everything from investments like stocks and shares to possessions, like vehicles and furniture. There are ways investors can defer CGT, read on to find out how.

How much is capital gains tax, and which rate of CGT do you pay?

The capital gains tax rates, sometimes referred to as the rate of cgt, vary depending on your circumstances and whether the gain is the result of the sale of residential property, which is charged at a separate rate. You only have to pay capital gains tax on gains that exceed the annual exempt amount.

The current capital gains tax-free allowance (2020/21) is £12,300 (£6,150 for trusts).

Basic rate taxpayers should do the following calculation to see whether their gain falls into the basic or higher rate.

Calculate how much taxable income you have. This is your income minus your personal allowance and any other income tax reliefs you are eligible for.

Work out your total taxable gains. That’s the profit you’ve made on the sale of each asset. Add them up, then deduct any allowable losses.

Deduct your tax-free allowance from your total taxable gains.

Add this amount to your total taxable income. This is your total.

The capital gains tax rates are as follows:

Higher tax rate: 20% rising to 28% for residential property.

Basic tax rate: 10% rising to 18% for residential property.

What is EIS and how can it help with capital gains tax?

The Enterprise Investment Scheme (EIS) is a venture capital scheme created by the UK government to help new businesses raise finance by offering tax reliefs to investors. The scheme has been around since 1994, so it's a well-established part of the UK tax landscape for investors. The types of relief include cgt, income tax relief, inheritance tax relief (iht), and loss relief in the event that an investment into a company goes bust.

To date, around £24bn in funds has been raised through the scheme, with 32,965 companies receiving investment.

This video gives a useful introduction to the scheme

How to defer capital gains tax through EIS investments

Investments into qualifying companies bring with them a suite of tax reliefs, and two of these relate to capital gains tax. The primary capital gains tax relief available is deferral relief.

If you have sold an asset and realised a taxable gain, then reinvest the gain into an EIS qualifying investment, you are given the option to defer that capital gain for as long as that money remains invested. There is no limit on the size of gains that can be deferred and you can defer gains on which you have already paid tax. Capital gains can be deferred indefinitely, if you continue to re-invest them into EIS funds or qualifying companies.

Worked example

If an investor makes a profit on the sale of an asset, this is considered a capital gain and capital gains tax is chargeable beyond a certain threshold. But if it occurs within the three years before or one year after purchasing shares in an EIS company or fund, they can defer this gain.

In this example, in 2019, a gain of £16,700 is earned. There is a chargeable gain of £5,000 beyond the 2019 CGT tax free allowance of £11,700. This chargeable gain is invested in an EIS fund and capital gains tax of £1,000 is deferred. When the shares are sold, a profit of £280,000 is made. On sale of the shares, capital gains tax becomes payable on the original amount deferred, and on the capital gain from the sale of the shares.

| Capital gain amount invested (July 2019) | £5,000 |

| After income tax relief of 30% | (£1,500) |

| Capital Gains Deferral (assuming CGT at 20%) | (£1,000) |

| Net cash outlay for investment | £2,500 |

| Shares Sold September 2022 | |

| Sale value of investment (for example) | £280,000 |

| Chargeable gain | £0 – no tax to pay if shares held for more than 3 years. |

| Deferred gain from 2018/2019 becomes chargeable 2022/2023 | £5,000 |

| *Tax payable on deferred gain at 20% (28% on residential property) | (£1,000) If EIS income tax relief is not claimed or not available.There will also be capital gains tax of £56,000 payable on the gain on the £5,000 invested. |

| Value of EIS deferral relief | £1,000 capital gains tax has been deferred for four years, in which money that would have been paid in tax has been invested and gained value. |

Please note the CGT tax free allowance for 2020/2021 is £12,300.

Get your free guide to the Enterprise Investment Scheme

All you need to know about the Enterprise Investment Scheme.

Featuring an analysis of UK investor trends, investment case studies and an EIS cheat sheet.

What other tax benefits are available through the Enterprise Investment Scheme?

Disposal Relief

The second benefit available to investors that relates to capital gains is disposal relief. When certain conditions are met, investors do not have to pay any capital gains tax on a gain from the disposal of EIS shares. Investors must have held these shares for at least 3 years, and have received income tax relief in full on all of their subscriptions for EIS shares, with no withdrawals of relief.

Loss relief

Investors that make a loss on any of their investments can offset that loss against their capital gains tax bill for that tax year.

Investments qualify for loss relief only when their value falls below the amount that was invested, after anything claimed in income tax relief has been deducted.

Inheritance tax relief

Shares held for a minimum of two years qualify for inheritance tax relief through BPR.

Getting started investing in EIS

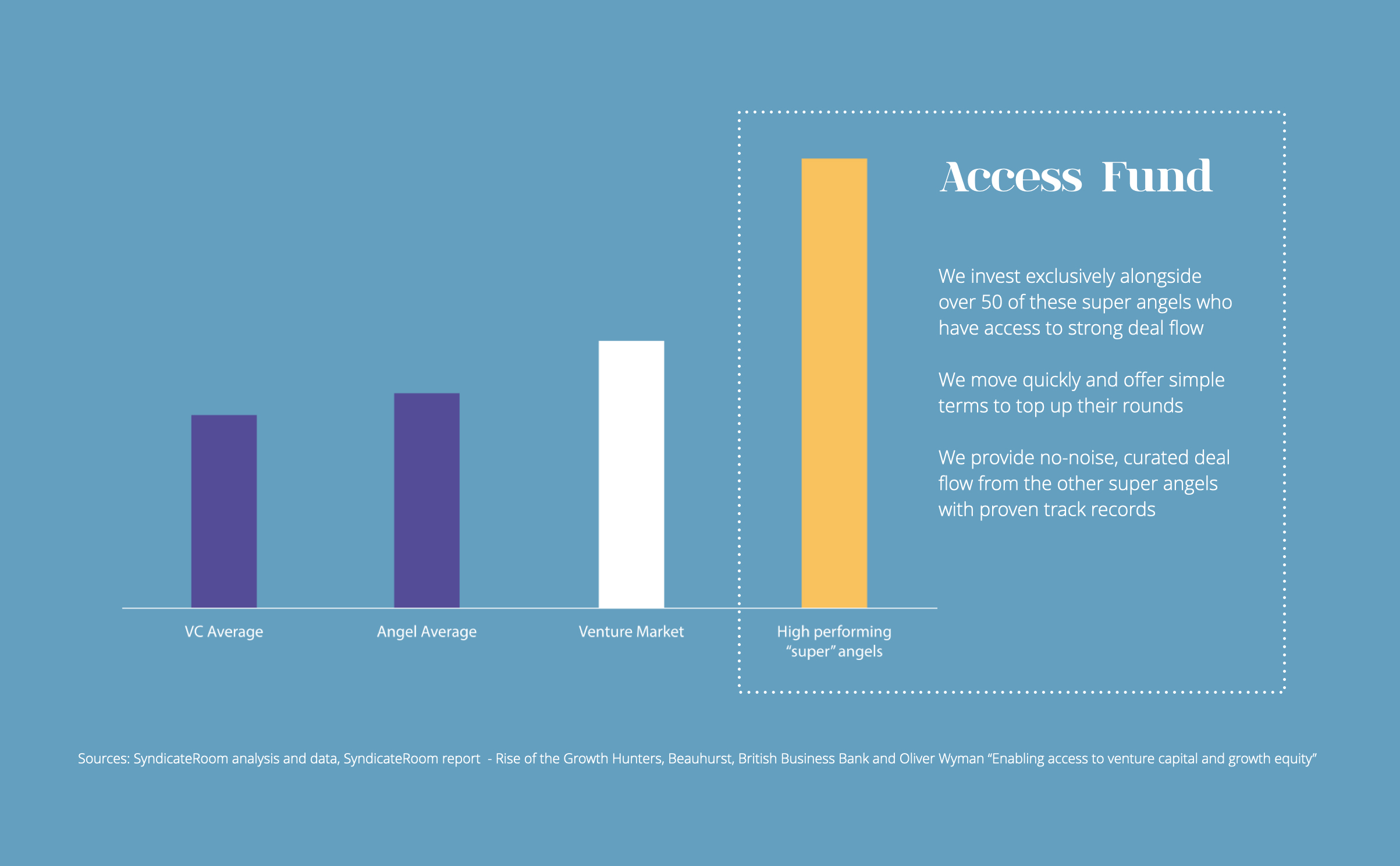

The fund we operate, Access EIS, tracks the performance data of over 1,000 active startup investors. It then selects and co-invests with some of the best-performing “super angels” with the aim of replicating their collective success, and diversifying your investment across at least 50 super-angel-backed startups to minimise risk and capture as many potential “blockbusters” as possible. The angels we co-invest with significantly outperform the market.

We make the process of claiming relief on multiple investments as simple as possible for our investors.

Find out more about the fund and the innovative startups we've backed here. If it’s right for you, we'd love to welcome you into our community of more than 500 investors.

Disclaimer.

The information on this page does not constitute financial advice and is provided on an information basis only, based on research using the following sources: