With the potential for high reward and a suite of attractive tax reliefs across income tax, capital gains tax, inheritance tax and more, investing in EIS is already appealing for many. But there are number of reasons that make 2024 a particularly good time to make this the year you start building your venture capital portfolio.

1. Tax free allowances are falling, driving the appeal of tax-efficient investment schemes.

The Autumn 2022 Budget saw the capital gains tax allowance more than halved from £12,400 to £6,000 from April 2023, with a further cut to £3,000 set to follow in April 2024. Dividend allowances were also halved, from £2,000 to £1,000, and will halve again in April 2024.

These developments, which coincided with an extension of the EIS sunset clause to 2035, have served to make EIS investing more attractive to investors thanks to the array of tax reliefs the scheme offers. These include capital gains deferral which allows investors to defer gains, and therefore tax payable on those gains, and capital gains tax disposal relief on EIS shares.

A major issue likely to face taxpayers through 2024 is fiscal drag. Thanks to tax bands remaining frozen, but wages increasing in line with inflation, an increasing number of people will find themselves paying a greater amount of income tax. Here too, EIS investing has you covered. EIS shareholders can claim 30% income tax relief on up to £1m (up to £2m if the first million is invested in knowledge-intensive companies), and the relief can be applied to the current year or rolled back to the previous year.

In short, as tax allowance changes and fiscal drag mean people will be paying more tax, EIS offers a tax-efficient toolkit to mitigate it.

2. Including an optimised amount of VC in your portfolio can lead to better returns while maintaining or reducing the risk profile of your overall portfolio.

For investors who want to benefit from the return potential of investing in startups without adding a greater degree of risk to their portfolio than they are comfortable with, there are ways of doing this.

Research conducted by corporate research business Hardman & Co demonstrates that investors with normal risk profiles (equity:bond portfolios that are between 60:40 and 80:20), who add an appropriate proportion of venture capital (10-20%) can add 0.5-1% to expected annual returns without increasing overall portfolio risk, even without any tax reliefs. You can view Hardman’s white paper here.

3. Investments in private companies are less affected by fluctuations in the market.

A number of recent geopolitical events have caused considerable fluctuations in the market that have negatively affected investors. For investors in publicly held companies, the impact of world events on the values of their stocks and shares is unavoidable, and can make investing in public companies unpredictable.

To make matters worse, even diversified portfolios of publicly traded stock tend to be highly correlated with each other simply because it is publicly traded. Private markets offer less-correlated investments that can help offset the volatility found in public markets, so diversifying into private assets can help to buffer your holding against market fluctuations.

Investments like EIS are long term, usually taking at least five years, and more often from seven to ten years to mature, which can make it a good way to safeguard an investment against market volatility.

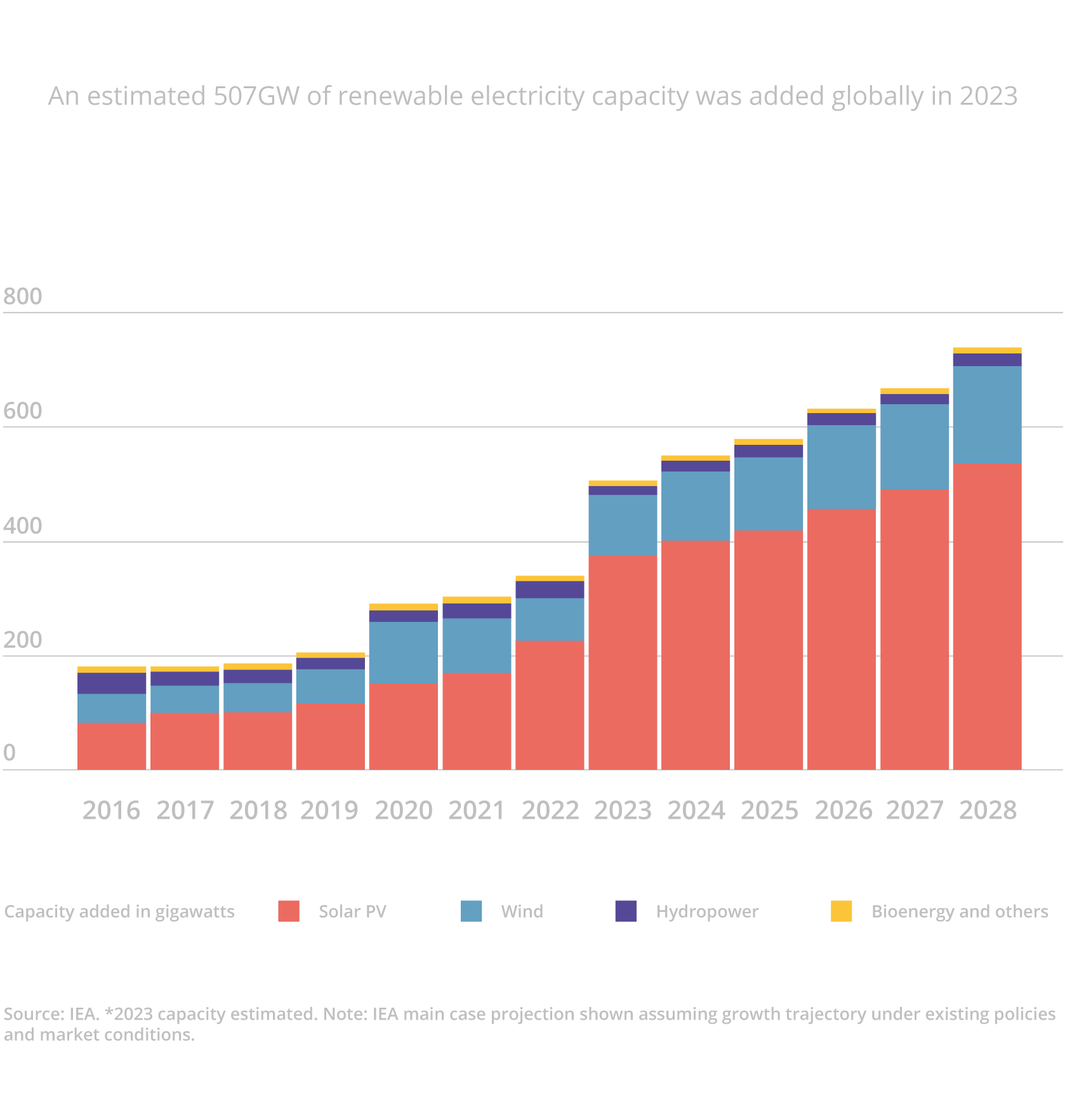

4. This is a very exciting time for many sectors, particularly green tech, artificial intelligence, and life sciences.

Market difficulties aside, a number of sectors are entering a particularly exciting phase of their evolution, and interested investors might want to consider getting in now. While all investors love to see returns, for many, the fact that their next investment could save lives, improve quality of life, create and develop renewable energy sources, or safely advance the latest generation of AI.

For more on the sectors that our network of angel investors have identified as ones that they plan to invest in, and our upcoming webinar series, see this article.

5. Investing in startups has a huge impact on job creation and economic growth.

Ready for some numbers? There are 5.58 million small and medium enterprises (SMEs) in the UK – companies with less than 250 employees – which represents 99.9% of the UK’s business population. They employ around 12.9 million people, or 48% of the workforce. In the private sector, SMEs account for 61% of employment, and more than half of the turnover. EIS investment in 2021 created over 26,000 jobs with over 60,000 further jobs supported or maintained by that investment.

Looking at the numbers it’s easy to see that investing in startups stands to have a significant impact on job creation and economic growth. While this might not be important to some, for many investors, the fact their investment helps to sustain a thriving startup ecosystem and encourage job creation and economic growth is significant.

High inflation through 2022 and 2023 means that now more than ever, companies need financing. If you’re looking to invest and make a difference, now is the time to do it.

6. Company valuations have been slowly falling.

As high interest rates have led to more investors keeping money in interest-bearing products the decrease in capital allocated to VC has led to companies reducing valuations to get investors onboard. This follows a period where valuations were considered by many investors to be excessively inflated and unrealistic.

There was a major surge in investment into VC funds in 2021, but a relatively low deployment rate as funds waited for company valuations to fall before deploying funds. This means that there is still significant capital waiting to be deployed into companies in 2024. It also means that for individual investors, this is a good time to invest in startups at a lower valuation than would have been previously available.

To find out more about how the Access EIS Fund can work for you or your clients. Use the button below to schedule a call with our expert, Ben Charrington.

Get your free guide to EIS and capital gains tax

Manage your capital gains with EIS.

The Enterprise Investment Scheme offers investors significant tax reliefs which range from income tax relief to capital gains tax (CGT) deferral and disposal relief. If you want to get up to speed on EIS CGT deferral rules, the CGT deferral relief time limit and more, download our free guide to how the capital gains tax reliefs work, how to claim them and how to get started as an EIS investor.

Register to learn

more about our data,

fund and venture capital