Towards the end of 2023, we surveyed our network of angel co-investors to find out what they’d be looking to invest in in 2024 (if you’d like to read more about their responses in full, take a look at our article here.

The areas they were most interested in were three sectors which easily capture the imagination, and the enthusiasm, of investor and non-investor alike: artificial intelligence (A.I.), life sciences, green and tech.

In the coming months we’ll be looking into each of these sectors in more detail: recent developments and innovations, their capacity for growth, and of course, their potential to transform the world as we know it. We’ll be speaking to the founders of some of our portfolio companies in each of these sectors in a series of webinars, so you can hear more about the frontlines of these industries from the mouths of people actively involved in carrying them forward. If you're not signed up for our newsletter, consider signing up now to be notified about when our next webinars will be. You can sign up using the option at the bottom of our homepage.

Let’s look at each of these sectors in a little more detail:

AI

Artificial intelligence has been a subject of discussion for decades, but it made an enormous leap forward in 2023 with the breakout of generative AI technologies which simplified new interfaces for creating high-quality text, graphics and videos using AI.

While OpenAI’s Chat GPT was one of the most headline-grabbing developments thanks to the impressive – and at times alarming – impression that AI was thinking for itself, there are myriad other businesses like Immersive Fox who began using generative AI to simplify the production of video for corporate applications. 2024 is considered by many investors to be the year when these initial applications of generative AI will see further development and rollout into other applications like ethics and policy monitoring, and a host of other emergent AI-focused roles. According to iShares, 70% of executives expect to increase AI resourcing in 2024.

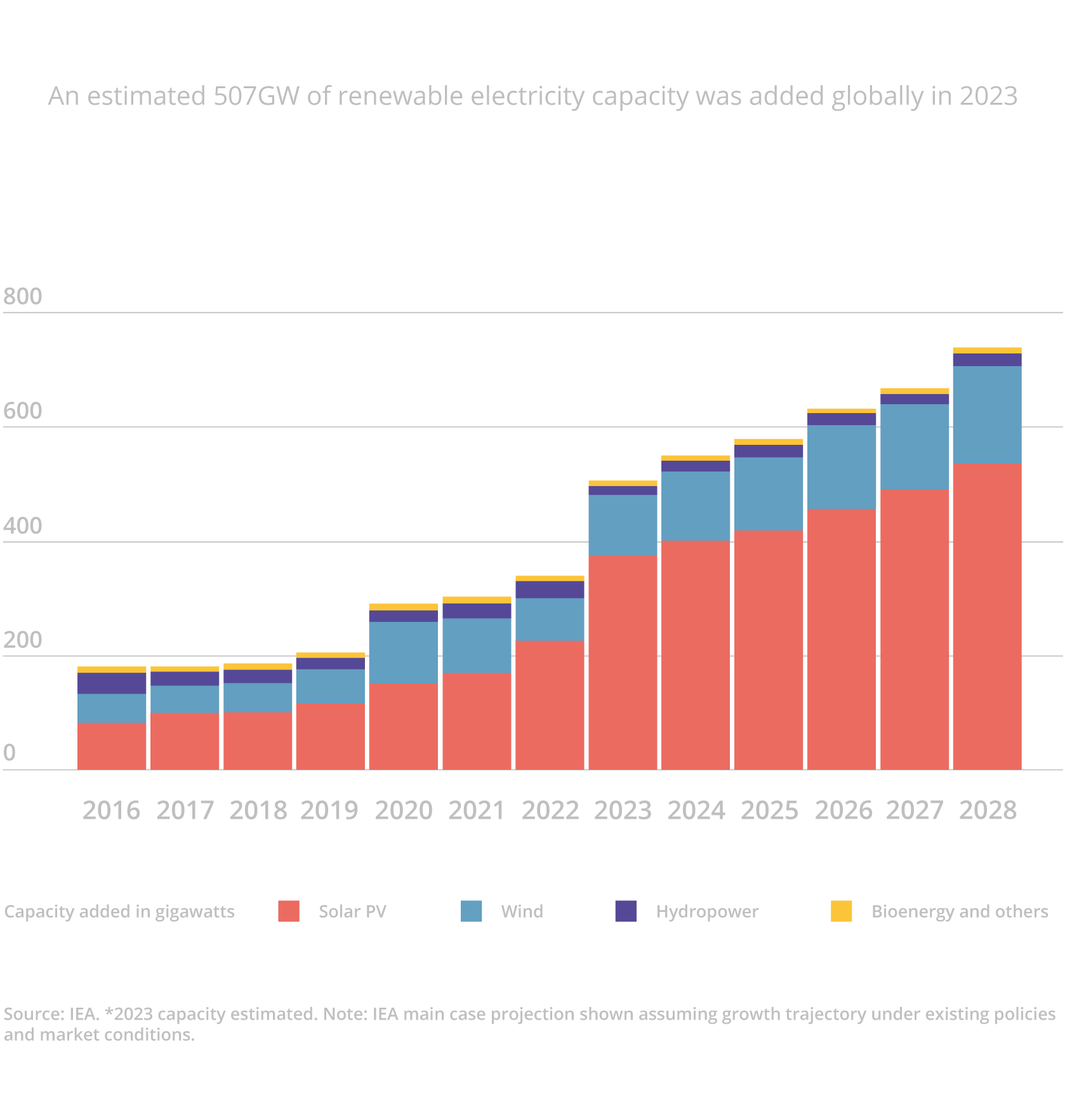

Green

In 2023, global renewable energy capacity grew at the fastest rate recorded in two decades, according to the International Energy Agency. 2023 saw the world’s renewable energy availability grow by 50%, making it the 22nd year in a row that renewable energy capacity growth set a new record.

As the effects of climate change become more obvious and the costs of inaction are more fully understood, the move away from fossil fuels towards renewable energy, battery technology, alternative fuel sources like hydrogen and sustainability tech continues to accelerate and diversify. Thanks to the fact that these kinds of investment generally have a significant impact – in the sense that their products represent a positive benefit – they are attractive to investors.

But as for why to invest in 2024, according to this article, 2023 was seen by many climate scientists as the high-water mark of fossil fuel usage, the final pinnacle before the industry begins a terminal decline. Naturally, excitement about the potential for green energy and technology – and the potential for growth and returns – makes investment in startups working on this technology at this time appealing to many investors.

Life sciences

Life sciences, health tech and biotech – in part thanks to the progress made by AI in 2023 – are sectors which are expected to expand and diversify through 2024. While investment in health tech declined in 2023, the proliferation of open-source and smaller, specialised models present new opportunities for healthcare AI startups in the year ahead. One particular area expected to develop as an opportunity for investors is longevity medicine, along with a broader movement towards data-driven, personalised healthcare that empowers consumers to take charge of their health and focus on prevention and longevity as central goals.

Tech

Long hailed for its resilience, ability to adapt and its potential to create solutions in even the most challenging circumstances – think remote working and digital healthcare during the COVID pandemic – technology’s growth potential, scalability and diversity continues to attract investors.

In 2024, with everything from new frontiers in generative AI to quantum computing, the evolution and expansion of electric vehicle technology, to the emphasis on sustainability upheld by many tech innovators, technology is in a more exciting place for investors now than ever before.

To find out more about how the Access EIS Fund can work for you or your clients. Use the button below to schedule a call with our expert, Ben Charrington.

Get your free guide to EIS and capital gains tax

Manage your capital gains with EIS.

The Enterprise Investment Scheme offers investors significant tax reliefs which range from income tax relief to capital gains tax (CGT) deferral and disposal relief. If you want to get up to speed on EIS CGT deferral rules, the CGT deferral relief time limit and more, download our free guide to how the capital gains tax reliefs work, how to claim them and how to get started as an EIS investor.

Register to learn

more about our data,

fund and venture capital